Understand and maintain your company’s financial health for sustained success. Explore four critical steps to determining your company’s economic well-being.

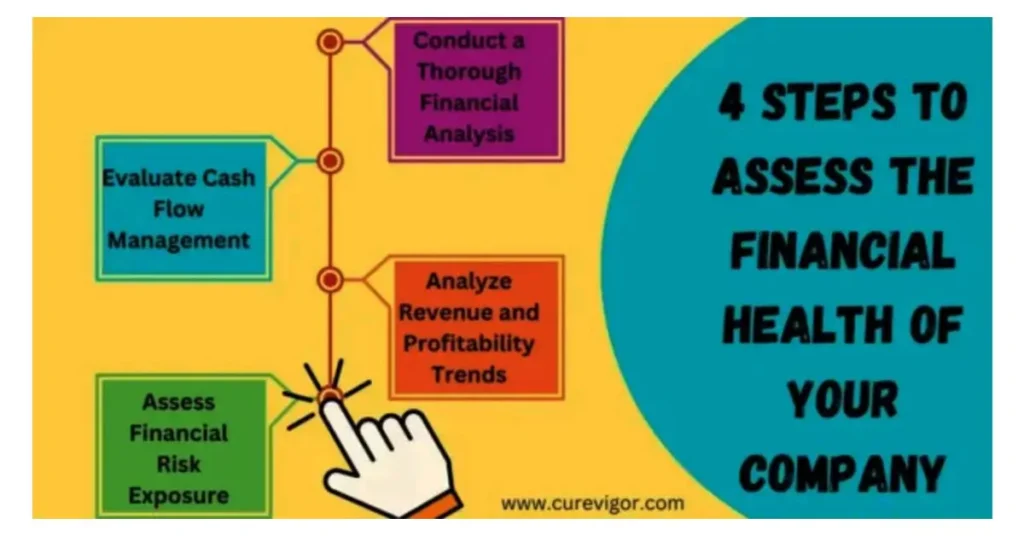

4 Steps to Determine the Financial Health

If you master these steps, your company will be better equipped to make informed decisions and prosper financially.

In today’s dynamic business landscape, understanding and maintaining your company’s financial health is paramount to sustainable growth and success. Here’s a comprehensive guide to help you navigate the intricacies of assessing your company’s economic well-being.

1. Conduct a Thorough Financial Analysis

Begin your financial assessment by conducting a detailed analysis of your company’s financial statements. The balance sheet provides a snapshot of your company’s assets, liabilities, and equity at a specific time. Analyze the liquidity ratios, such as the current and quick ratios, to assess your company’s ability to meet short-term obligations.

Next, delve into the income statement to evaluate your company’s revenue, expenses, and net income over a specific period. Identify trends in revenue growth and profit margins to gauge your business’s overall profitability.

Finally, scrutinize the cash flow statement to track the cash movement in and out of your company. Please pay close attention to operating, investing, and financing activities to ensure your company maintains adequate cash reserves to support its operations and growth initiatives.

2. Evaluate Cash Flow Management

Effective cash flow management ensures your company’s financial stability and sustainability. Evaluate your company’s cash flow management practices to identify any inefficiencies or areas for improvement.

Implement cash flow forecasting to anticipate future cash needs and proactively manage cash inflows and outflows. Monitor accounts receivable and accounts payable to optimize cash conversion cycles and improve working capital efficiency.

Consider implementing cash flow improvement strategies such as negotiating favorable payment terms with suppliers, reducing unnecessary expenses, and accelerating the collection of accounts receivable. By optimizing cash flow management, you can enhance your company’s liquidity and resilience to economic uncertainties.

3. Analyze Revenue and Profitability Trends

Track and analyze revenue and profitability trends over time to identify critical drivers of your company’s financial performance. Conduct a thorough analysis of sales channels, customer segments, and product offerings to identify opportunities for revenue growth and margin expansion.

Identify trends in customer demand and market dynamics to anticipate shifts in revenue streams and adjust your business strategy accordingly. Evaluate the profitability of individual products or services to allocate resources effectively and maximize overall profitability.

Implement pricing strategies, cost optimization initiatives, and revenue diversification efforts to enhance your company’s revenue and profitability. By analyzing revenue and profitability trends, you can make informed decisions to drive sustainable growth and profitability.

4. Assess Financial Risk Exposure

Assess the level of financial risk exposure your company faces to mitigate potential threats to its financial stability. Identify external factors that may impact your company’s economic performance, such as market volatility, competitive pressures, and regulatory changes.

Conduct scenario analysis to assess the potential impact of adverse events such as economic downturns, supply chain disruptions, or changes in interest rates on your company’s financial position. Develop risk mitigation strategies to minimize exposure to financial risks and protect your company’s assets and interests.

Consider diversifying your revenue streams, securing adequate insurance coverage, and maintaining a robust financial contingency plan to mitigate the impact of unforeseen events.

By proactively assessing and managing financial risks, you can safeguard your company’s financial health and resilience in an increasingly uncertain business environment.

Conclusion

In conclusion, maintaining a healthy financial position is essential for your company’s long-term success and sustainability. By following these four basic steps, you can gain valuable insights into your company’s financial health and take proactive measures to ensure its continued prosperity and growth.

Remember, proactive financial management is not just about the present; it’s investing in your business’s future resilience and growth.

FAQs

Q. What is the financial assessment?

A financial assessment comprehensively evaluates a company’s financial health and performance. It involves analyzing various financial metrics, ratios, and indicators to assess the company’s liquidity, solvency, profitability, and overall economic stability.

Q. What is an example of a financial assessment?

An example of a financial assessment is conducting a thorough analysis of a company’s financial statements, including the balance sheet, income statement, and cash flow statement. Critical financial ratios such as liquidity ratios (e.g., current ratio), profitability ratios (e.g., net profit margin), and solvency ratios (e.g., debt-to-equity ratio) are used to assess the company’s financial position and performance.

Q. What four measures are used to assess financial performance?

Four key measures used to assess financial performance include:

- Liquidity ratios: Measure a company’s ability to meet short-term obligations.

- Solvency ratios: Assess a company’s ability to meet long-term debt obligations.

- Profitability ratios: Evaluate a company’s ability to generate profits relative to its revenue, assets, or equity.

- Efficiency ratios: Measure how effectively a company utilizes its resources to generate revenue or profits.

Q. How do you assess a company’s financial health?

To assess a company’s financial health, you can thoroughly analyze its financial statements, evaluate vital financial ratios, trends, and indicators, and compare its performance to industry benchmarks. Additionally, assessing cash flow management, revenue diversification, and risk exposure can provide valuable insights.

Q. What four financial statements are used to monitor a company’s financial health?

The four main financial statements used to monitor a company’s financial health are:

- Balance sheet: Provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time.

- Income statement: shows a company’s revenue, expenses, and net income over a specific period.

- Cash flow statement: Tracks the cash movement in and out of a company, including operating, investing, and financing activities.

- Statement of changes in equity: Summarizes changes in a company’s equity over a specific period, including contributions, distributions, and retained earnings.

Q. What are the four measures included in a company’s financial report?

The four main measures included in a company’s financial report typically include:

- Financial statements include a balance sheet, income statement, cash flow statement, and equity change statement.

- Financial ratios: Liquidity ratios, solvency ratios, profitability ratios, and efficiency ratios.

- Trend analysis: comparison of financial data over time to identify patterns, trends, and areas of improvement or concern.

- Interpretation and commentary: analysis and explanation of the financial results, including key findings, insights, and recommendations for management and stakeholders.

Read more articles on Health and Wellness.

You might like to read:

How to Ensure Sun Protection for You and Your Family: Expert Tips and Guidelines