Explore the dynamic role of a financial analyst and learn where they work. From analyzing economic data to providing strategic insights, learn about financial analysts’ essential roles and diverse work environments.

Thank you for reading this post, don't forget to subscribe!How to Become a Financial Analyst and Thrive in Your Career

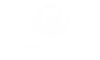

A Financial analyst measures the economic health of businesses, industries, and markets to guide individuals and organizations into sound investment and financial decisions. They collect, analyze, and present financial data by recommending investments, budgets, and the best financial planning.

Understanding the Role of a Financial Analyst

- Analyzing financial data: Financial analysts interpret data from the balance sheet, income statement, cash flow statement, and market trends to appraise a firm’s financial position.

- Making Investment Recommendations: Financial analysts research possible investments through stocks, bonds, or other financial instruments and advise clients or businesses on the best avenues to maximize return.

- Forecasting and Modeling: Financial analysts develop models that help predict future performance, revenues, expenses, and cash flows using historical data and market conditions. This helps in decision-making.

- Risk Assessment: Financial analysts assess risk associated with investing or business decisions and provide strategies to reduce financial losses.

- Monitor Market Trends: Analysts stay informed about economic trends, industrial developments, and geopolitical activities that may impact the financial markets and company performances.

- Creating Reports and Presentations: Financial analysts elaborate detailed reports, summaries, and presentations for stakeholders regarding their findings and actionable insights.

- Budgeting and Planning: Other financial analysts work for companies that produce financial plans, set budgets, and look into the future to predict what will happen financially.

Types of Financial Analysts

- Buy-side analysts: These are analysts who serve companies that buy investments, such as pension funds, mutual funds, or insurance firms, and assist them in deciding where to invest.

- Sell-Side Analysts: They work with several brokerage houses by preparing reports for clients or traders in which they recommend them to purchase or sell stocks.

- Corporate Financial Analysts: They work within companies while analyzing internal financial data, estimating future earnings, and providing input for future corporate decision-making.

Skills Required:

- Analytical Skills: Deciphering data from complex financial reports and their implications.

- Attention to Detail: Small mistakes in the interpretation of data can have serious financial consequences.

- Communication Skills: They must present their findings to non-financial stakeholders and clients.

- Technical Skills: The ability to create a finance model, execute operations within a spreadsheet, and manipulate other specialized computer applications, including Excel or other applications used for financial analysis, is essential.

Financial analysts are critical as they assist individuals, corporations, and institutions in making strategic financial decisions to obtain maximum returns and mitigate risks effectively.

Financial Analyst Job Description

A financial analyst evaluates financial data to help businesses, investors, and institutions make informed decisions. Their core role involves analyzing financial statements, market trends, and economic forecasts to provide insights that guide strategic financial planning. They assess investment opportunities, forecast revenues and expenditures, and evaluate risk to help clients or employers make decisions that align with their financial goals.

Financial analysts typically work in various sectors, including investment banking, corporate finance, asset management, and insurance. Their daily tasks involve interpreting large datasets, creating financial models, preparing reports, and making recommendations based on data analysis. They are vital in advising businesses on mergers and acquisitions, budgeting, and investment decisions.

Key Responsibilities:

- Analyzing financial statements and industry data

- Forecasting financial performance and identifying trends

- Providing recommendations on investment strategies

- Evaluating risk factors and suggesting mitigation strategies

- Creating financial models to predict future performance

- Preparing detailed financial reports for stakeholders

- Monitoring market trends and economic indicators

How to Become a Financial Analyst

To become a financial analyst, you’ll need a combination of education, skills, and relevant experience. Here’s a step-by-step guide on how to enter this career field:

- Earn a Bachelor’s Degree: The first step is to obtain a bachelor’s degree in finance, economics, accounting, or a related field. A strong foundation in mathematics, statistics, and business concepts is essential.

- Gain Relevant Experience: Internships or entry-level finance, banking, or investment firm positions are critical to gaining practical experience. It can provide exposure to financial reporting, market analysis, and data interpretation.

- Consider Advanced Education or Certifications: While not always required, obtaining a master’s degree (such as an MBA) or professional certifications can enhance your credentials. Certifications like CFA (Chartered Financial Analyst) or CPA (Certified Public Accountant) are highly valued in the field.

- Develop Analytical and Technical Skills: Financial analysts rely heavily on data analysis, so proficiency in Excel and financial software is crucial. Strengthening skills in economic modeling and quantitative analysis is also beneficial.

- Network and Stay Updated: Networking with industry professionals and staying informed about economic trends, stock markets, and industry developments will help you stay competitive.

- Apply for Financial Analyst Roles: Once you’ve gained the necessary qualifications and experience, apply for financial analyst positions in sectors such as investment banking, asset management, corporate finance, or insurance.

Top Skills for a Financial Analyst

A successful financial analyst needs a combination of technical, analytical, and interpersonal skills to evaluate financial data and provide recommendations effectively. Here are the top skills required:

- Analytical Thinking: Financial analysts must have strong analytical abilities to interpret complex financial statements and data sets and identify trends and insights.

- Financial Modeling: Expertise in building financial models is essential. Analysts use these models to forecast future performance, assess risks, and evaluate investment opportunities.

- Attention to Detail: Given the critical nature of their work, financial analysts must be attentive to detail to ensure that their analyses and recommendations are accurate and reliable.

- Proficiency in Financial Tools: Knowledge of financial analysis software, Excel, and tools like Bloomberg Terminal or FactSet is necessary for interpreting data and making informed predictions.

- Communication Skills: Financial analysts must be able to present their findings and recommendations to non-financial stakeholders, often through reports and presentations.

- Understanding of Markets and Economics: A firm grasp of market trends, economic indicators, and global financial conditions is critical to making informed investment and financial decisions.

- Problem-Solving Skills: Financial analysts must be able to think critically and offer solutions to complex financial problems or unexpected challenges.

- Time Management: Managing multiple projects or reports simultaneously requires excellent organizational and time-management skills.

Is a Financial Analyst Career Right for You?

A career as a financial analyst can be gratifying, but it’s essential to assess whether it aligns with your interests, skills, and career goals. Here are a few factors to consider:

- Do You Enjoy Working with Data?

Financial analysts spend much time working with large datasets, financial statements, and statistical models. This career may be a good fit if you enjoy interpreting data and deriving insights from numbers.

2. Are You Detail-Oriented and Analytical?

Attention to detail and analytical thinking are key to success in this role. Financial analysts must be able to critically analyze data, identify patterns, and make sound recommendations based on their findings.

3. Are You Comfortable with Pressure?

The financial industry can be fast-paced and high-pressure, especially when dealing with tight deadlines or high-stakes investment decisions.

4. Do You Have a Strong Interest in Finance and Economics?

A passion for understanding markets, economies, and financial systems is essential. Staying updated on current events, market trends, and global economic conditions is a big part of the job.

5. Are You Willing to Pursue Certifications?

While a degree is a starting point, additional certifications such as a CFA, CPA, or MBA can significantly boost your career prospects. A financial analyst role may suit your commitment to ongoing learning.

6. Do You Enjoy Problem-Solving?

Financial analysts often work on solving complex financial challenges, such as identifying the best investment strategies or mitigating financial risks. If you’re a natural problem solver, this career might suit you.

Work Environments of Financial Analysts

Financial analysts work in diverse settings across various industries, including:

Investment Banks

Investment banks are financial institutions that facilitate complex financial transactions, such as mergers and acquisitions, underwriting of securities, and advisory services. Financial analysts in investment banks play a crucial role in:

- Analyzing Market Trends: Conducting in-depth research and analysis of market trends, economic indicators, and industry developments to identify investment opportunities and risks.

- Conducting Due Diligence: Performing rigorous due diligence on potential investment opportunities, including assessing financial statements, valuing assets, and evaluating business strategies.

- We are providing Recommendations: Generating comprehensive reports and presentations to inform clients about investment strategies, asset allocation, and risk management recommendations.

Asset Management Firms

Asset management firms specialize in managing investment portfolios on behalf of individual and institutional investors. Financial analysts in asset management firms are responsible for the following:

- Managing Investment Portfolios: Designing and implementing investment strategies tailored to meet the objectives and risk tolerance of clients, such as pension funds, endowments, and high-net-worth individuals.

- Conducting Research on Securities: Conducting thorough research and analysis of various securities, including stocks, bonds, and derivatives, to identify investment opportunities and optimize portfolio performance.

- Monitoring Performance: Continuously monitoring the performance of investment portfolios, analyzing market trends, and making strategic adjustments to maximize returns and mitigate risks.

Corporate Finance Departments

Corporate finance departments are integral parts of corporations responsible for managing financial activities, including financial planning, budgeting, and analysis. Economic analysts in corporate finance departments contribute by:

- Supporting Financial Planning and Analysis (FP&A) Activities: Preparing financial forecasts, budgets, and strategic plans to guide decision-making and achieve corporate objectives.

- Preparing Financial Reports: Generating financial reports, including income statements, balance sheets, and cash flow statements, to provide insights into the company’s financial performance and position.

- Conducting Financial Analysis: Analyzing financial data and key performance indicators to identify trends, assess profitability, and evaluate the economic impact of business decisions.

Consulting Firms

Consulting firms provide advisory services to businesses across various industries, offering strategy, operations, and finance expertise. Financial analysts in consulting firms contribute by:

- Providing Financial Advisory Services: Offering strategic advice and solutions to clients on financial matters, including mergers and acquisitions, restructuring, and capital allocation.

- Conducting Financial Analysis: Conducting detailed financial analysis, including modelling, valuation, and scenario analysis, to support client engagements and decision-making processes.

- Offering Strategic Recommendations: Collaborating with clients to develop and implement strategic recommendations to improve financial performance, enhance shareholder value, and achieve business objectives.

Government Agencies

Government agencies play a vital role in formulating and implementing economic policies, regulations, and initiatives. Financial analysts in government agencies contribute by:

- Conducting Economic Research: Conducting research and analysis on economic trends, indicators, and policy implications to inform government decision-making and policy development.

- Analyzing Fiscal Policies: Assessing the impact of fiscal policies, including taxation, government spending, and budgetary measures, on the economy, businesses, and individuals.

- Providing Financial Analysis: Offering financial analysis and expertise to support government initiatives and programs, such as infrastructure projects, public investments, and economic development initiatives.

These diverse settings offer unique opportunities for financial analysts to apply their skills, expertise, and knowledge to analyze financial data, provide strategic insights, and drive informed decision-making across various industries and sectors.

FAQs

Q. Why is a financial analyst a promising career?

Financial analysis is considered a rewarding career for several reasons:

- Lucrative Salary: Financial analysts typically receive competitive salaries and bonuses, making it a financially rewarding career choice.

- Growth Opportunities: The demand for financial analysts is expected to grow, providing ample opportunities for career advancement and professional development.

- Intellectual Challenge: Financial analysis involves complex problem-solving and critical thinking, offering intellectual stimulation and continuous learning opportunities.

- Impactful Role: Financial analysts are crucial in shaping business decisions, investment strategies, and financial outcomes, contributing to organizational success and growth.

- Versatility: Financial analysts can work in various industries, including finance, consulting, healthcare, and technology, offering versatility and the opportunity to explore different sectors and roles.

Q. What do financial analysts analyze?

Financial analysts analyze various aspects of economic data and market trends, including:

- Financial Statements: These are income statements, balance sheets, and cash flow statements used to assess a company’s financial performance and position.

- Ratios and Metrics: These include profitability, liquidity, and solvency ratios to evaluate financial health and performance.

- Market Trends: Including economic indicators, industry trends, and market movements to identify investment opportunities and risks.

- Investment Opportunities: These include stocks, bonds, commodities, and other financial instruments to assess potential returns and risks.

- Risk Factors: Market volatility, credit risk, and operational risk to identify and mitigate potential threats to financial stability.

Q. What motivates you to become a financial analyst?

Individuals may be motivated to become financial analysts for various reasons, including:

- Passion for Finance: A genuine interest in financial markets, economic trends, and investment strategies.

- Analytical Skills: I enjoy analyzing data, solving complex problems, and making informed decisions.

- Career Growth: Aspiring for career advancement, professional development, and opportunities to work in diverse industries.

- Impact: Desire to contribute to organizational success, make a meaningful impact, and drive positive financial outcomes.

- Financial Rewards: Attracted to the competitive salaries, bonuses, and perks associated with a career in economic analysis.

Q. What are the top 3 skills for financial analysts?

The top three skills for financial analysts include:

- Analytical Skills: Ability to analyze complex financial data, identify trends, and interpret insights to inform decision-making.

- Financial Modeling: Proficiency in building and using economic models to forecast performance, evaluate investment opportunities, and assess risk.

- Communication Skills: Effective communication skills, including verbal and written communication, to present findings, articulate recommendations, and collaborate with stakeholders effectively.

Conclusion on Financial Analysts

Financial analysts drive financial decisions and strategies across various industries and organizations. Whether in investment banks, asset management firms, corporate finance departments, consulting firms, or government agencies, financial analysts contribute their expertise to analyzing financial data, assessing risks, and providing strategic insights. By understanding the diverse roles and work environments of financial analysts, we gain insight into the intricate workings of the financial world and the indispensable contributions of these professionals.

In conclusion, if you’re detail-oriented, analytical, and passionate about finance, a career as a financial analyst could be an excellent match for your skills and interests. It offers significant opportunities for growth, especially for those with strong technical skills and the ability to navigate the ever-evolving financial landscape.

Read more articles on Health and Wellness.

You might like to read: