Discover how 5 Proven Budgeting Tips to Reduce Money Stress and Balance Your Work and Personal Life can help you regain control, improve financial planning, and enjoy a healthier work-life balance.

Thank you for reading this post, don't forget to subscribe!What is Money Stress

Money stress has become one of the most common yet least discussed struggles of modern life. People work longer hours, chase promotions, and earn more than previous generations, yet still feel anxious about bills, savings, and the future.

This contradiction is exhausting. It quietly affects mental health, productivity, and personal relationships.

The truth is, financial peace is not only about earning more. It is about managing what you already have with clarity and intention. That is where budgeting tips play a powerful role.

When applied correctly, budgeting reduces anxiety, supports better decision-making, and creates space for both professional success and personal fulfillment.

This article on 5 Proven Budgeting Tips to Reduce Money Stress and Balance Your Work and Personal Life is designed to help you take control without feeling restricted.

These strategies are practical, realistic, and built for real life—not perfection.

Simplify Your Finances with These Budgeting Tips

Simplifying your finances is the foundation of financial wellness. Many people feel overwhelmed not because they lack money, but because their financial systems are complex.

Multiple accounts, forgotten subscriptions, unclear expenses, and irregular savings create confusion and stress.

Effective budgeting tips simplify financial decision-making. When your system is simple, you spend less time worrying and more time living. Simplicity helps you see where your money is going, why, and whether it aligns with your priorities.

Reducing money stress begins with clarity. A simplified budget removes emotional noise and replaces it with confidence. Once finances feel manageable, balancing work and personal life becomes far more achievable.

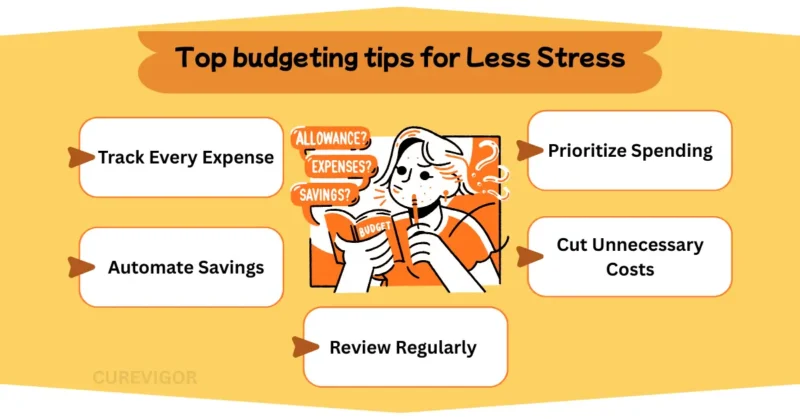

Top budgeting tips for Less Stress

Budgeting is not about perfection. It is about progress. The following budgeting tips focus on sustainability, not pressure. Each tip addresses both financial stability and emotional balance, because money decisions never exist in isolation from the rest of life.

Reducing financial stress does not require extreme discipline or complicated systems. What it truly requires is consistency, self-awareness, and realistic planning.

The following budgeting tips are designed to work with real human behavior, not against it. Each one supports both financial stability and emotional well-being, helping you stay calm, focused, and in control even when life feels unpredictable.

These budgeting tips are not quick fixes. Instead, they build a stable financial rhythm that reduces anxiety over time and supports a healthier work-life balance.

Track Every Expense

Tracking every expense is often the moment when financial clarity begins. Many people believe they know where their money goes, yet are surprised when they see the actual numbers. This gap between perception and reality is a major source of money stress.

Tracking expenses is not about control or self-criticism. It is about observation. When you observe your spending without judgment, you create space for better decisions.

Narratively, this habit shifts you from reacting to money problems to understanding them. Awareness replaces fear. Patterns replace confusion.

Key ways tracking expenses reduces stress:

- Reveals hidden spending habits that quietly drain income

- Highlights which expenses bring real value and which do not

- Creates a sense of control through visibility

- Reduces anxiety caused by uncertainty

Over time, this budgeting tip turns money from a source of stress into a predictable system you can manage with confidence.

Prioritize Spending

Not all spending deserves equal importance. One of the most powerful budgeting tips is to prioritize where your money goes rather than spreading it too thin across too many areas.

When spending is unintentional, guilt often follows. When spending is intentional, peace replaces guilt. Prioritizing spending means deciding in advance what matters most to you and aligning your budget accordingly.

This budgeting tip works because it respects human values. Money is not just numbers; it reflects choices, priorities, and identity.

Practical ways to prioritize spending:

- Identify top life priorities such as health, family, education, or freedom

- Fund these priorities first before discretionary spending

- Reduce spending in areas that do not support your goals

- Allow flexibility for enjoyment without financial regret

When spending aligns with values, budgeting stops feeling restrictive and starts feeling empowering.

Automate Savings

Automation is one of the smartest budgeting tips for reducing stress because it removes emotion from financial decisions. Instead of relying on willpower, automation relies on systems.

When savings are automated, progress happens quietly in the background. You do not have to remember, decide, or negotiate with yourself each month. This simplicity reduces mental fatigue and builds consistency.

Narratively, automation creates a sense of safety. Knowing that savings are growing without constant effort provides emotional reassurance, especially during uncertain times.

Benefits of automating savings:

- Eliminates procrastination and decision fatigue

- Builds financial security consistently over time

- Reduces temptation to overspend

- Supports long-term goals without daily attention

This budgeting tip lets you focus on your work and personal life without constantly worrying about money.

Cut Unnecessary Costs

Cutting unnecessary costs is often misunderstood as deprivation. In reality, it is about refinement. This budgeting tip focuses on removing expenses that add stress rather than value.

Many unnecessary costs go unnoticed. Subscriptions renew quietly. Convenience spending becomes habitual. Over time, these small costs create financial pressure without improving the quality of life.

This budgeting tip works best when approached thoughtfully rather than aggressively.

Examples of unnecessary costs to review:

- Subscriptions or memberships are rarely used

- Impulse purchases driven by stress or fatigue

- Convenience expenses that replace planning

- Lifestyle upgrades that do not improve happiness

When waste is reduced, money feels less tight. This creates emotional relief and financial flexibility without sacrificing enjoyment.

Review Regularly

A budget is a living system, not a fixed rulebook. Regular reviews are essential to keeping it relevant and stress-free. Life changes constantly, and your budget must change with it.

This budgeting tip prevents small issues from becoming overwhelming problems. Regular check-ins allow you to adjust before stress builds.

Narratively, reviewing your budget builds confidence. Each review reinforces the idea that you are in control, even when circumstances change.

Effective budget review habits include:

- Monthly reviews to track progress and adjust categories

- Reviewing irregular expenses before they become emergencies

- Celebrating small wins to stay motivated

- Adjusting goals based on real-life changes

Consistent reviews turn budgeting into a supportive habit rather than a stressful obligation.

Why Budgeting Reduces Money Stress More Than Earning More

Many assume that higher income automatically reduces stress. In reality, without a financial structure, stress often increases as income rises. Lifestyle inflation, unclear priorities, and unmanaged obligations grow silently.

Budgeting provides predictability. Predictability reduces anxiety. Knowing where money goes and why helps build confidence and emotional stability. Even modest incomes feel manageable when expenses align with purpose.

This is why 5 Proven Budgeting Tips to Reduce Money Stress and Balance Your Work and Personal Life focuses on behavior rather than just numbers. Financial peace comes from control and clarity, not income alone.

Common Budgeting Mistakes That Increase Stress

Some budgeting habits unintentionally create pressure. Over-restricting, ignoring irregular expenses, or comparing finances with others often leads to discouragement. Budgets should serve life, not dominate it.

Another common mistake is treating budgeting as a one-time task. Life changes, and budgets must adapt. Flexibility and regular review prevent frustration and financial fatigue.

Avoiding these pitfalls helps keep budgeting supportive rather than stressful.

How Budgeting Improves Relationships and Emotional Well-Being

Money stress often spills into relationships. Miscommunication, hidden spending, and unmet expectations create tension. Budgeting encourages transparency and shared goals.

When finances are openly discussed and planned together, trust strengthens. Decisions become collaborative rather than confrontational. Emotional safety increases alongside financial stability.

This relational benefit is often overlooked, yet it is one of the most powerful outcomes of intentional budgeting.

Building Long-Term Financial Confidence

Confidence grows through consistency. Small, repeated financial wins build momentum over time. Paying off debt, building savings, and meeting monthly goals reinforce belief in personal capability.

Budgeting transforms money from a source of fear into a tool for empowerment. This confidence spills into work performance, decision-making, and overall life satisfaction.

Simple Finance Tracker Sheet (Copy & Use)

You can copy the tables below directly into your preferred spreadsheet tool.

Monthly Income Tracker

| Date | Income Source | Amount | Payment Type | Notes |

Monthly Expense Tracker

| Date | Expense Category | Description | Amount | Payment Method |

Fixed Expenses Overview

| Expense Name | Due Date | Monthly Amount | Paid (Yes/No) |

Savings & Goals Tracker

| Goal Name | Target Amount | Current Savings | Monthly Contribution |

Weekly Budget Review

| Week | Planned Spending | Actual Spending | Difference | Notes |

Monthly Reflection Notes

- Biggest spending win this month:

- One expense to improve next month:

- Savings progress summary:

- Stress level compared to last month:

How to Use This Finance Tracker Effectively

- Update expenses daily or weekly to stay aware

- Review totals at the end of each week

- Adjust spending categories as life changes

- Focus on progress, not perfection

This tracker is designed to support budgeting, reduce financial stress, and improve work-life balance—without overwhelming you.

Frequently Asked Questions

Q. What are the five tips for budgeting?

The five essential budgeting tips start with tracking every expense to understand spending habits. Prioritizing needs over wants helps align money with personal goals.

Automating savings ensures consistency without effort. Cutting unnecessary costs creates breathing room in your finances. Regular budget reviews keep your plan realistic and adaptable.

Q. How can budgeting reduce stress?

Budgeting reduces stress by replacing uncertainty with clarity and control. Knowing where money goes eliminates constant worry about bills and expenses. It helps you plan for emergencies rather than react to them.

Financial predictability improves emotional stability. Over time, budgeting builds confidence and peace of mind.

Q. What is the three-sixty rule of money?

The three-sixty rule focuses on financial security and long-term planning. Three months of expenses have been set aside for short-term emergencies. Six months provide stability during income disruption.

Nine months represent strong financial resilience. This rule encourages gradual, sustainable savings rather than pressure.

Q. What is the ten-fifty-three rule in finance?

The 10-5-3 rule is a simple guideline for personal finance planning. Ten percent of income is saved or invested regularly. Five percent is set aside for personal enjoyment or lifestyle needs.

Three percent is reserved for learning or self-improvement. This balance supports growth without burnout.

Q. What are five stress management strategies?

Effective stress management starts with setting clear priorities and boundaries. Regular physical activity helps regulate emotions and energy levels. Mindful breathing or meditation reduces mental overload.

Time management prevents last-minute pressure. Financial planning also reduces stress by increasing stability and control.

Q. What are the seven steps to financial freedom?

Understanding your income and expenses clearly is the first step toward financial freedom. Eliminating high-interest debt reduces long-term pressure. Building an emergency fund creates safety.

Consistent saving and investing grow wealth over time. Living below your means increases flexibility. Continuous learning improves decision-making. Long-term planning ensures sustainability.

Conclusion

Financial stress is not a personal failure; it is often a systems problem. Without structure, even high incomes feel fragile. With intention, even modest resources feel empowering.

The 5 Proven Budgeting Tips to Reduce Money Stress and Balance Your Work and Personal Life are not about control or sacrifice.

They are about awareness, flexibility, and alignment. When money supports life rather than competes with it, balance becomes possible.

Budgeting is not the end of enjoyment. It is the beginning of peace.

Call to Action

Taking control of your money does not require a perfect plan—it requires a first step. The budgeting tips shared in this guide are meant to simplify your finances, not complicate them.

When you begin tracking your money with intention, clarity replaces confusion, and confidence slowly replaces stress.

Start small. Choose one budgeting habit today and commit to it for the next thirty days. Whether it is tracking expenses, automating savings, or reviewing your budget weekly, consistency matters more than intensity.

Financial peace is built through steady progress, not instant results.

Start today if you’re prepared to lessen financial stress and establish a better work-life balance. Your future self will thank you for the clarity, stability, and freedom you create today.

Read more articles on Work Life Balance.

You might like: